Tax-Exempt Status

- Esz Connor

- Feb 7, 2022

- 2 min read

A denomination typically files for group exemption to cover all local churches. A copy of the body's IRS determination letter may be used by the local group to provide evidence of tax-exempt status.

Independent local churches that are not a part of a denominational body often file for tax-exempt status to obtain evidence of their status.

If a local congregation ordains, licenses, or commissions ministers, it may be helpful to apply for tax-exempt status. Ministers that are ordained by a local church may be required to provide evidence that the church is tax-exemption from self-employment tax.

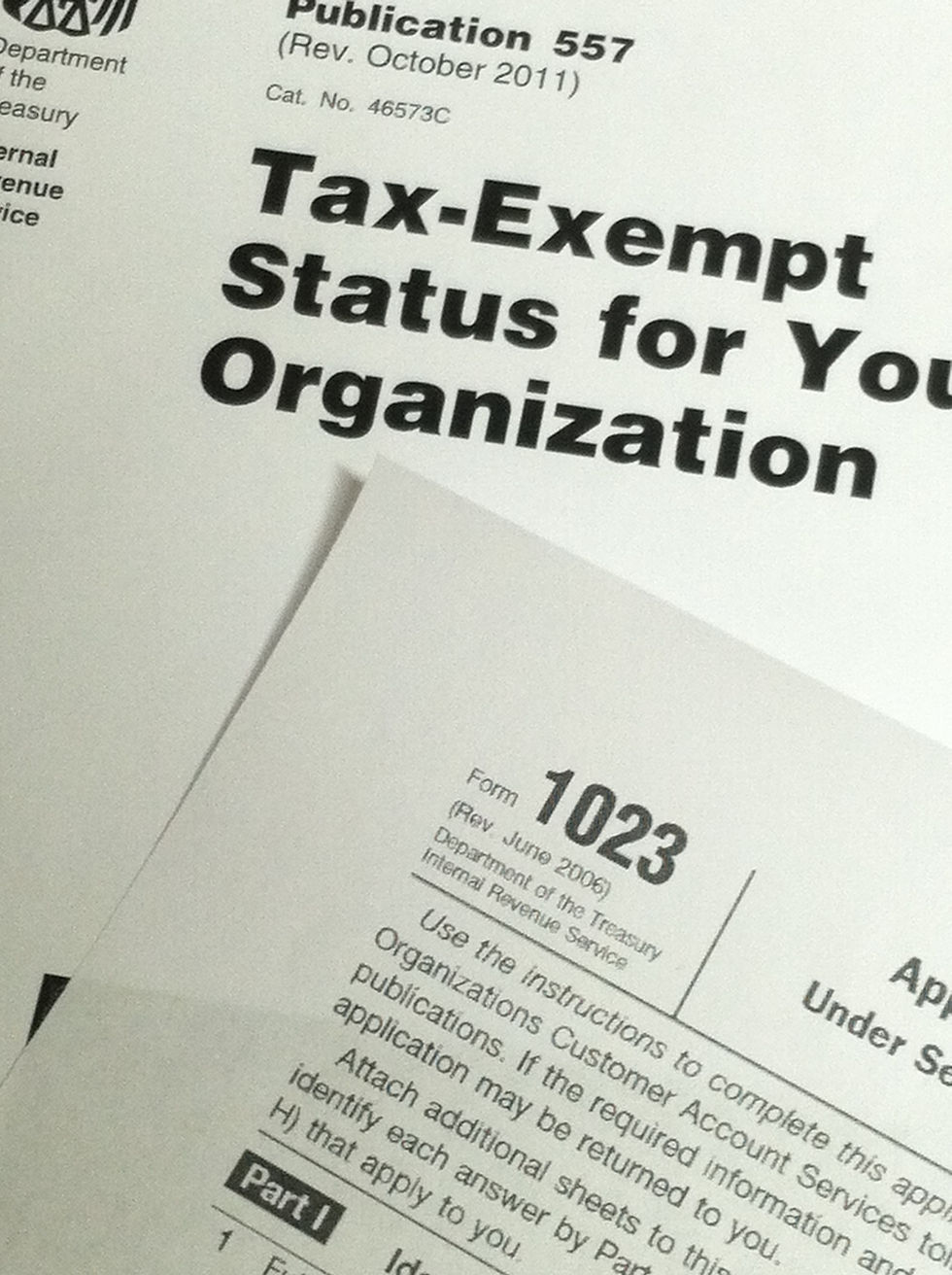

Organizations desiring recognition of tax-exempt status must submit Form 1023 or Form 1023-EZ. The streamlined Form 1023-EZ may generally be used by most ministries with annual gross receipts of $50,000 or less and total assets with fair market value of $250,000 or less.

The IRS must be notified that the organization is applying for recognition of exemption within 27 months from the end of the month in which it was organized. Applications made after this deadline will not be effective before the date the application is filed

Organizations that have applied and been approved for tax-exempt status are reflected on the IRS website in the "Tax-Exempt Organization Search" database.

Determination Letter

A user fee of $600 must accompany Form 1023 applications for recognitions of tax-exempt status. (www.pay.gov) to pay the appropriate fee for a determination letter request.

Group Exemption

Churches that are part of a denomination are not required to file a separate application for exemption if they are covered by the group letter. Group exemption letter fees are $3,000.

The central organization is required to report annually its exempt subordinate. The central organization is responsible to evaluate the tax status of its subordinate groups.

Comments